Trigger #5

Follow My Blog

Get new content delivered directly to your inbox.

Problem: How Government Influences Economic Growth?

Introduction

Government undoubtedly influence economic growth. The real question is how? What types of economies are there around the world? How do government policies effect the economy? How and what kind of challenges might occur? To attempt to solve this problem, I will be delving into different economical methods used around the world. Remembering our trigger, I think of words like politics, subsides, taxes and how they used to make a society grow. I am sure that with research I will find it no surprise that both government and economics are multifaceted. To try and grasp exactly how the growth happens my readers will see that there are many ways in which the government influences the economy and more importantly, the international community.

Learning Objective #1: Types of Economy?

Traditional Economic System

Beginning with the most traditional economic system, we can see that a large majority of the world uses this system. Most of these areas are rural, second or even third world countries. In these types of economies overproduction is rare. According to the source, these societies tend to be very close nit societies and socially content. However, countries that fall into this category tend to lack technology or advanced machinery (Intelligent Economist 2020.)

Command Economic System

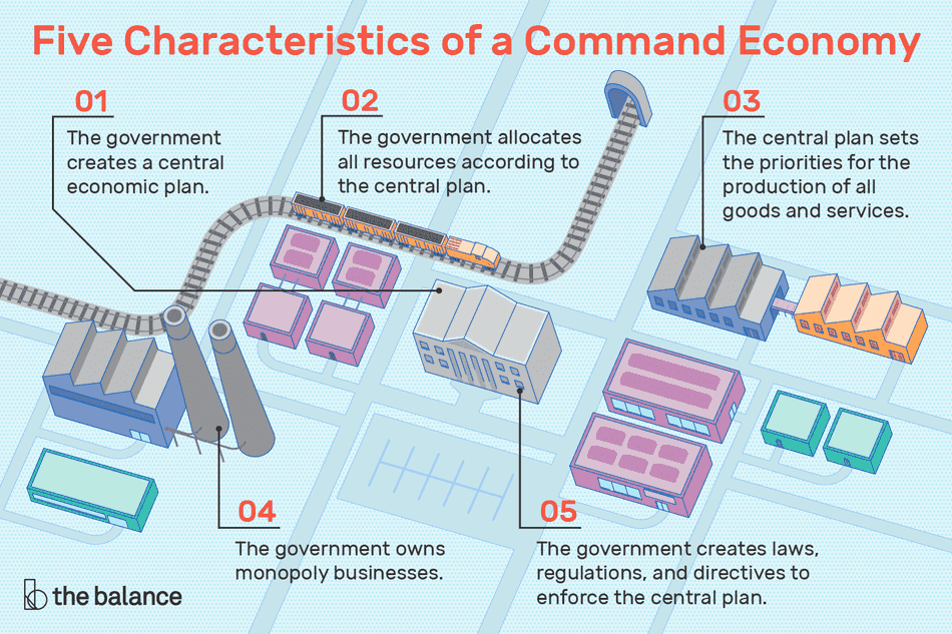

As shown in the diagram above, there are five steps in a command economy process. First a plan being created by the government. Next the allocation of resources. Followed by priorities being set for products and services. Continuing with government owned monopoly business. Finishing with laws, regulations, and directives to enforce the central plan.

One of the major advantages to this type of economy is that it can manipulate large amount of supplies for larger products without environment regulation or lawsuits.

A disadvantage to this type of economy, is that good production is not always met with demand, and bad strategizing can make the possible of rationing. Another is that innovation in this type of system is often discouraged (The Balance 2020.)

Market Economic System

Market Economy is primarily based on supply and demand. It encourages economic freedom and understand the shift in supply and demand should be adjustable. According to the source, one of the advantages to this type of economy is harder working employees. There reasoning is that if there is a threat of a lost job due to the product not selling that remains prevalent throughout their employment. Also, that companies tend to adjust and innovate in order to meet new audiences and produce better products are a cheaper price.

One of the disadvantages to a Market economy is the exploitation of workers sometimes occurs. Large companies have moved location with the goal in mind of hiring cheap labor. These laborer’s can often be subject to poor working environments. Another disadvantage stated by he source is that machinery can sometimes become idol due to overproduction. Sometimes this overproduction can result in layoffs to individual workers. This ultimately makes the individual worker insecure about keeping their employment (The Insurance Advice, 2020).

Mixed Economic System

A source describes the meaning of a mixed economy as a “golden mixture of both capitalism and socialism. A mixed economic system is free of economic activities and government interferences for the social welfare. Resulting in a mix of both economies. Some countries have adopted this system speed up the growth of economic development. In this type of economy, both private and public sectors tend to cooperate with one another. In doing so they both can exercise economic command (Economic Discussion 2020.)

One of the advantages of a mixed economy is that it allows for private businesses to run their companies and make profits. While at the same time contributing towards the welfare of society. However, this can also lead to some disadvantage.

One of those disadvantages is that under this type of economy private enterprises sometimes face difficulties. The reasoning for these difficulties is favoritism and bureaucratic nature which that is prevalent in this type of system. Another disadvantage of this system is that a noticeable gap between rich and poor.

After examining the different types of economies let us take a look at a few examples of successful economies using the different types.

Learning Objective #2: Government Policies and Their Challenges?

Government will evitable be involved in economic policy. Governments influences on policies can be measured by how much they try to influence those policies. A national budget dictates this measurement. Governments typically use three main principles to negotiate methods of economic control. Those methods are allocated function, stabilization function, and the distributive function. Let us briefly research these functions and also examined a few direct ways government influences policy.

Functions

The first function we well further examine is the allocated function. The allocated function serves as a determining factor on where revenue will be spent. A high amount of national income contributes to public expenses. Allocation of those amounts become more significant in terms of pollical and economic terms. In democracy, those allocations are continuously disagreed and debated. For example, a government might need to choose in which where to spend its money on, a defensive force, or healthcare. The changing of national governments results in a continuing search for the correct moral and ethical answers. (Wise Geek, 2020).

Now let us inspect the stabilization function. The stabilization functions purpose is to keep a steady growth of economy and prevent any significant spikes or drops. The government, or its central bank aim is to minimalize any price change. Maintaining an effective stabilization policy requires monitoring of business cycle, and adjusting benchmark interest rates as needed to manipulated changes in demand. To better understand, its purpose is to prevent dramatic changes within the economic output. This generally results in less unemployment due to a healthy gross domestic product (GDP) (Investopedia 2020).

The final function we will examine is the distributive function. Through taxes and expenditure polices, government affects distribution of personal income in a manner that is considered fair. However, that distributive function, and how much to tax in democracies is almost always debated. This is aimed poor, middle, and upper class of income households for members of society. This is done to prevent unfair distribution on income in a free market system. If the government feels it is necessary, they intervene to try and make income fair enough for everyone to live comfortably. This is notion assumes that collective judgement can come to a decision for a desired income. (Encyclopedia Britannica, 2020.)

So what is the real question after looking at the three functions above. Why does government get involved in business activities? Businesses are created most of the time for profit as its main purpose. A business might take advantage of their customers, neglect environmental issues, or produce unsafe or hazardous products if without any form of regulation. Employees might even use unfair tactics to combat their competition. Or a company might flat out lie in using the media to advertise a product with fallible information. A example of acts imposed by government involvement in this are listed below:

Trade Description Act: purposely giving false impression about a product is illegal.

Consumer Credit Act: According to this act, consumers should be handed a copy of the credit agreement and should be aware of the interest rates, length of loan while taking a loan.

Sale of Goods Act: It is illegal to sell products with serious defects or problems and goods sold should match to the description given.

Now, by looking at these examples we can see that these acts are protection for the consumer. They also aim to prevent abuse or misinformation given to the customer in order to turn a profit. As much as wed like to assume these companies are acting in an ethical manner, these acts try to prevent a company from manipulation of its consumer base.

Now besides a few acts showing a desire for the government to protect the customer, what ways do they take from the customer via policy?

Taxes – Taxes reduce the income of individuals and companies which in turn reduces private expenditures. The basic objective of these tactics is to provide resources to the public. A few examples being public transportations, roadways, public schools, hospitals, parks and playgrounds. However, taxes can also be used exercise control in the private sectors. This is done to motivate the purchase or consumption of certain products which are lightly taxed and to discourage purchase of items that are heavily taxed.

Subsides – Subsidies is a financial benefit given by a government, which gives an advantage to a business or individual. There are different forms of subsides, such as cash, tax exemptions, government procurement policy, and stock purchases.

In the simplest terms, government involvement in the economy aimed at promoting stabilization and growth. However, without that intention breeds complexities and tough decision making in order to avoid challenges. However, what kind of challenges am I referring to? Starting with one of the most important lets take a look at a few examples:

Energy and Environmental Security

This ha emerged as a major issue in the global economic agenda. Governments vary on their opinions on how to properly reduce global dependency on fossil fuels and greenhouse gas emissions.

Conflict and Poverty

There is a link considered to be present in regards to global conflict and poverty. For example in the United States policymakers traditionally view security threats that involve bullets and bombs but are now beginning to focus more on how poverty contributed to conflict.

Rising of New International Powers

International Economy and the Government that contributes to it have particularly rising powers, For example, India, China and Brazil economies are now have more ammo to engage and directly global economy. Wit their growth comes the structed change of international produce and trade, the nature of and direction of money flow, and patterns of natural resource consumption. This is essentially forcing global great powers to come to terms with working together in international economic policy and shared management of those systems within. (Brookings, 2007.)

Conclusion

So how does government influence economic growth? If we review the above information, we as readers can see government influences economic growth in a multitude of ways. We can see that there are at least three major different types of economies. We can also see that through the allocative factor, stabilization factor, and distributive factor, government is almost a puppet master keeping the economic peace using policy in order to created and or maintain a stable society. The problem how does government influence economic growth should have included the word hinder. I would have like to include the word simply because governments can through our research hinder a particular business or individual. We can also see through our examples of challenges that individual governments effect the international community as a whole.

References:

Brookins, Top Ten Global Economic Challenges Assessment of Global Risks and Priorities URL:

https://www.brookings.edu/research/top-ten-global-economic-challenges-an-assessment-of-global-risks-and-priorities/

Accessed: 06 March 2020

The Balance. Command Economy, Characteristics, Pros and Cons 2020 URL:

https://www.thebalance.com/command-economy-characteristics-pros-cons-and-examples-3305585

Accessed: 04 March 2020

Economic Discussion. Mixed Economy. Meaning, Features, and Types of Mixed Economy, 2020. URL:

http://www.economicsdiscussion.net/economy/mixed-economy-meaning-features-and-types-of-mixed-economy/2064

Accessed: 04 March 2020

Encyclopedia Britannica. Government Economic Policy 2020. URL:

https://www.britannica.com/topic/government-economic-policy

Accessed: 06 March 2020

Lets Learn Finance. Advantage and Disadvantages of a Mixed Economy 2020. URL:

https://www.letslearnfinance.com/advantages-disadvantages-mixed-economy.html

Accessed: 04 March 2020

The Insurance Advice. Advantages and Disadvantages of a Market Economy 2020. URL:

https://theinsuranceadvice.com/market-economy-advantages-disadvantages/

Accessed: 04 March 2020

Intelligent Economist. Types of Economy’s 2020 URL:

https://www.intelligenteconomist.com/types-of-economies/

Accessed: 04 March 2020

Investopedia. Stabilization Policy. URL:

https://www.investopedia.com/terms/s/stabilization-policy.asp

Accessed: 06 March 2020

Wise Geek. What is Economic Policy? URL:

https://www.wisegeek.com/what-is-an-economic-policy.htm#didyouknowout

Accessed: 06 March 2020

Key Words: Corruption, Policy, Bureaucracy Relation, Taxes, Economic and Social Policy, Micro and Macro Trade, Exchange Rate, Monetary Policy, Subsidies, and Business Climate